A few months back I was contacted by two academics based at the University of Wollongong, New South Wales. They are economic geographers and were starting a project looking at local and international tonewood markets.

Chris Gibson and Andrew Warren came to Hobart and I was pleased to catch up and discuss issues around tonewood supply and tonewood markets.

On their way to writing a book on the subject they have published the first academic paper from their research so far.

Chris Gibson & Andrew Warren (2016): Resource-Sensitive Global Production Networks: Reconfigured Geographies of Timber and Acoustic Guitar Manufacturing, Economic Geography, DOI: 10.1080/00130095.2016.1178569

http://www.tandfonline.com/doi/pdf/10.1080/00130095.2016.1178569

Unfortunately this paper doesn’t make for easy reading with 22 pages of dense, convoluted prose.

I would encourage the authors to write a shortened popular version of the paper as I have no doubt they would find plenty of consumer and industry magazines and websites keen to publish.

Here’s my review.

Where in the 1970’s and 1980’s labour costs and shifts in production to cheap labour markets were the dominant force in the guitar industry, today it is access to secure, reliable wood resources that is becoming the major industry driver. This is happening within an increasingly complex, increasingly regulated international trade in wood resources.

Such [increasing] regulation [and diminishing supply] has, since the 1990s, transformed both tonewood procurement and guitar making. A resource-sensitive GPN has emerged in which upstream resource actors are increasingly important, with manufacturing firms responding differently to scarcity and regulation. Other industries dependent on timber, such as paper milling, furniture, and the construction industry are not as species dependent and have been able to switch more easily to substitutes, including quick-growing plantation species sourced locally. Guitar manufacturers for the most part remained bound by the guitar’s type form, requiring timbers with tensile strength, aesthetics of color and grain, and rich acoustic resonance. Moreover, as a form of manufacturing appealing to consumers for whom emotional value and identity-affirming qualities were intrinsic, the industry was encumbered with strong traditions and customer expectations. As Dick Boak, from C. F. Martin & Co., explained, convincing guitarists to switch to instruments made from sustainable materials proved difficult: “musicians, who represent some of the most savvy, ecologically minded people around, are resistant to anything about changing the tone of their guitars”. Put simply, “musicians cling to the old materials”.

As I’ve said previously, guitar companies are often their own worst enemies when it comes to product development, marketing and mixed/confused messages. Even the most evangelical of guitar manufacturers still provide a soft, oblique message to the market when it comes to environmental issues. But the aesthetic and the exotic become the focus when it comes to sales and marketing. Many guitar companies show no concern about resource supply and environmental issues whatsoever.

https://blackwoodgrowers.com.au/2015/08/11/ooops-not-such-a-success/

But there is evidence that consumer and market change is coming. Just a few examples include the No More Blood Wood campaign, the Leonardo Guitar Research Project, and the Musicians for Sustainable Tonewoods:

http://reverb.org/no-more-blood-wood-campaign/

http://www.leonardo-guitar-research.com/

https://www.facebook.com/Musicians-for-Sustainable-Tone-Wood-100977326654291/

The 2009 and 2011 raids on the Gibson Guitar Company by US law enforcement agencies in relation to importing endangered species were a watershed moment for the guitar/tonewood industry, sending shockwaves throughout the marketplace and concerned consumers.

Irrespective of the evidence and veracity of the raids, in August 2012, Gibson settled out of court, effectively admitting to violating the Lacey Act, and agreed to a $300,000 fine.

Since 2011 the international tonewood market has changed dramatically. The paper highlights three strategies being used by guitar manufacturers to adjust to the changing tonewood market:

- Alternative species

- Vertical integration

- Salvage wood

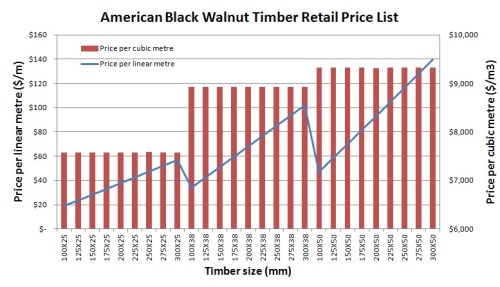

In short, material scarcity in combination with higher degrees of CITES/Lacey Act enforcement made legally sound international procurement of traditional timbers more difficult, inconsistent in quality, and expensive. Accordingly, product innovation ensued, entailing new models that shifted away from rosewoods, ebonies, and mahoganies of potentially suspicious provenance, toward new alternative timbers that satisfied strength, resonance, and aesthetic benchmarks, and that could be sourced either locally or more transparently from countries with robust regulation, certification, and enforcement.

Well that is a trend that is only just beginning. If you look at most guitar websites you will still find rosewood, mahogany and ebony in abundance.

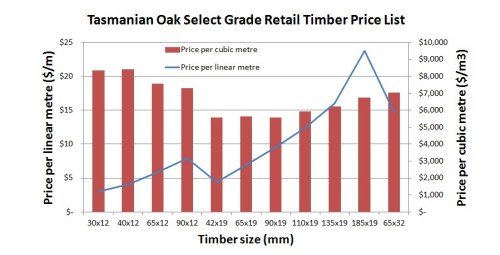

Much of the search for alternative species is focused on other tropical rainforest timbers not on the CITES list. A few American companies are increasing their focus on readily available North American hardwood species. In Australia the two commercial makers, Maton and Cole Clark, are increasing their use of locally grown and native timbers.

Taylor Guitars so far is the only major company following the vertical integration pathway back up the supply chain to timber cultivation, harvesting and milling. This is really only an option for large companies that have the resources necessary to invest upstream.

Rather than engaging in the expensive option of buying land and growing trees themselves, these companies should consider the option of contracting the growing and supply of tonewood to local farmer cooperatives. I’m pretty confident that if a major company pursued this option in Tasmania it would receive plenty of positive support from the farming community.

The third strategy being developed by small-to-medium size guitar companies is the use of salvage wood from specialised “timber hunters”. The problem here is that salvage wood is not a secure long-term resource. It comes with increased risk of resource supply. It also doesn’t help the major manufacturers and therefore the bulk of the guitar-buying public who can’t afford custom built guitars, ie. there are no large volumes of salvage wood available.

So how can Tasmanian blackwood feature in these three tonewood strategies?

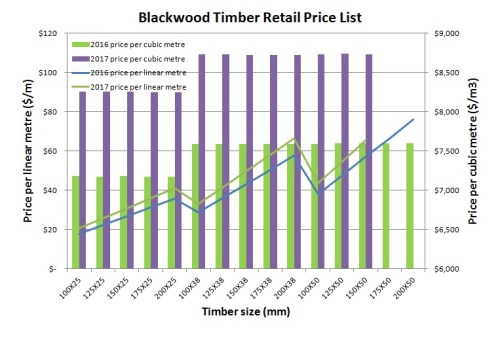

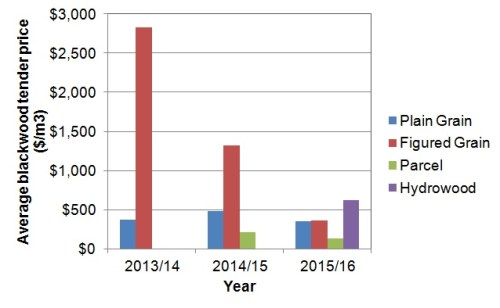

- Tasmanian blackwood is one of the few alternative quality tonewood species that is non-tropical and potentially sustainable. It can be grown in profitable commercial plantations. It is well known in the domestic Australian market but has yet to break into the international market. Efforts by Taylor and Cort to introduce blackwood into international markets will hopeful make progress in this area.

- Taylor Guitars have strong links with their Tasmanian supplier (Tasmanian Tonewoods) but have yet to demonstrate any commitment beyond this relationship. To date their vertical integration is confined to the USA, and Cameroon in Africa in partnership with Madinter. Will other major guitar companies follow Taylor’s lead and seek upstream supply relationships?

- There is a sizable existing blackwood resource suitable for salvage on farmland across northern Tasmania, from Goulds Country in the east, to Marrawah on the west coast. This unmanaged resource of native remnant and planted blackwood could be used to stimulate farmer interest in growing commercial blackwood, whilst supplying international tonewood markets in the short term, should a major buyer wish to take up this opportunity.

Tasmanian blackwood is discussed on page 19 of the paper.

Following the Australian lead (Maton and Cole Clark), North American tonewood suppliers and manufacturers began importing Australian blackwood to use in high-end production guitars. A species considered invasive in some areas (unlike practically all other tonewoods), Australian blackwood is harvested in small volumes from farms and mixed-forest plantations without the need for invasive harvesting techniques or CITES paperwork (Reid 2006).

I don’t know where the mixed-forest blackwood plantations are? I’ve never heard anything about them. And why mention the invasive bit? The invasive tendencies of other species are not discussed at all. If blackwood is planted on Tasmanian farms where it is already a native how can it be considered invasive?

The only way that the tonewood market can have a secure future is to pay landowners to grow trees. Unfortunately the paper fails to discuss this strategy, I guess because so far none of the guitar companies are actually using this strategy.

Major manufacturers need significant volumes of quality timber and they need resource security to safeguard their investment. This means paying people to actually grow trees, and having strong, long-term relationships with growers.

The paper focuses on the current changing dynamics in the international tonewood market which are still in their infancy.

As the paper states, the current changes are unpredictable and likely to result in unexpected outcomes as new players and new opportunities emerge. The interplay between the consumer, the manufacturer, the supply chain, and the grower will result in significant market changes.

One important piece of information missing in the paper is an estimate of the size of the international tonewood market. In all the dense discussion it is not possible to get a sense of scale of the issue. On pages 10-11 there is a table providing some statistics about example companies, including production and employment, but nothing about tonewood demand.

Another observation is that the paper talks about the tonewood market everywhere from sawmillers/tonewood merchants all the way through to consumers; but fails to discuss forests, plantations and growers. If there’s a tonewood supply problem then not discussing trees and growers seems a bit odd.

So who will grow the tonewoods of the future?

I’m looking forward to seeing what these academics come up with over the next year or so of their project.

The forests behind the label – Why standards are not enough

Here’s a great Ted Talk about going beyond Forest Certification with the focus on small scale forest growers like existing and potential Tasmanian blackwood growers.

And when I think about the synergies between their connect-with-the grower model and a Tasmanian Blackwood Growers Cooperative I get excited.

This is just what Tasmanian blackwood growers need to get the support and recognition.

It’s about connecting consumers and manufacturers with forest growers.

What a great idea!

The Ted Talk is by Constance McDermott who is a James Martin Senior Fellow and Chair of the Forest Governance Group at the Environmental Change Institute, University of Oxford.

http://www.eci.ox.ac.uk/people/cmcdermott.html

This is a 12 minute talk well worth watching.

Leave a comment

Posted in Commentary, Cooperatives, Markets, Support, Tonewood

Tagged Constance McDermott, Ted Talk