Having had a few discussions recently about blackwood prices and price lists I have begun to investigate this aspect of the forest industry and the marketplace. Pricing a commodity that takes 20-100+ years to grow requires stepping outside the realms of normal economic theory. And when you are a retailer and not a grower, are you rewarding and motivating the grower, or are you killing the forest industry?

What the market is prepared to pay, product substitution and technology become critical issues. This is particularly true in the wood commodity markets such as pulp, paper and construction which accounts for the lion’s share of the wood market.

But what about the premium end of the wood market where wood quality and appearance are fundamental aspects of the market? This market exhibits a significant degree of inelasticity (with a high capacity to pay), and a resistance to product substitution, as well as technological change. This is the market that Tasmanian blackwood inhabits.

From a blackwood growers viewpoint, how does pricing affect grower behaviour? Most premium timbers around the world come from (public and private) native forests. Few premium timbers are grown in plantations. Economic management and performance of native forests is quite different to growing timber in plantations. Compared to native forests plantations have high establishment and management costs, with little or no income from the investment until harvest in 20-30+ years time. As a straight investment this requires careful planning and management in order to achieve a reasonable profit from the investment (not to mention a great deal of passion and patience).

So what does the marketplace tell us about the economics of growing trees for premium quality wood production?

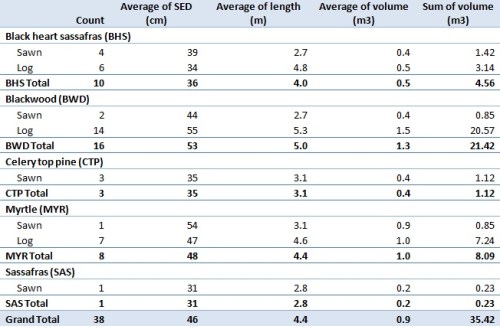

Here’s an example of a real blackwood price list of dimensions and prices per linear metre. I then calculated the price per cubic metre for each of the dimensions and made a chart of the results. The prices are for kiln-dried rough-sawn (KDRS) clear-grade blackwood.

I was horrified!

This pricing and pricing structure will kill the blackwood industry stone dead!!

Firstly I don’t know too much about the costs of regulation, harvesting, transport and sawmilling, but I suspect the growers of this blackwood got bugger all for their trees.

If the retailer is selling blackwood for $AU2,500 per cubic metre regardless of size, what did they pay the sawmiller? And after paying the costs of planning, harvesting, transport and sawmilling, what did the sawmiller pay the poor growers? I reckon the growers got the clear message that growing commercial blackwood is for mugs and losers!

Instead of providing incentive and reward for their blackwood growing efforts the marketplace punished these growers.

So do we want the forest industry to have a future?

It won’t have a future with this retail pricing!

Do we want to be able to buy blackwood timber in the future?

There wont be any to harvest if these prices continue?

I don’t know where in Tasmania the blackwood timber came from but it wasn’t plantation grown. It could be public or private native forest; meaning these trees were between 40 and 80 years old when harvested.

The second failing of this price list is the complete absence of the cost of “time”.

Time costs money. That’s what interest rates are all about. They represent the cost of money over time – for either loans or investments.

In general the price of timber reflects the volume/size of the piece of wood. The greater the dimensions and length the greater the price. The above pricing structure would be fine IF blackwood was produced in a factory where the ingredients were fed into one end of a machine and the various sizes and lengths came out the other end, with little time involved in production.

Unfortunately blackwood timber grows on trees and trees take time to grow, and time costs money. The bigger the piece of timber the bigger the tree required, and the longer it takes to grow, and greater the cost to the grower/investor.

But the above pricing list says that size (and hence time) has no cost. Wrong!!

The above list says that a cubic metre of 25x25mm costs the same to grow/produce as a cubic metre of 125x125mm. Wrong!!

You can cut 25x25mm timber from young 30 cm diameter trees, but you need much older 60+ cm diameter trees to produce 200×50 mm or 125x125mm blackwood.

A common complaint in the premium timber market is the scarcity of wide boards. However the above price list fails to provide any incentive/reward to the grower to grow bigger older trees.

A common caveat in the premium timber market goes something like:

Availability of specific sizes and lengths cannot be guaranteed.

This is largely due to the wood being sourced from native forest where tree size and supply are relatively random. In forestry lingo it’s called “run of the bush” – whatever turns up.

Plantations however are highly controlled and managed, so that (if things work out) size and supply can be better managed. A bit of tree selection and breeding and wood quality and supply is more assured. No caveats required.

So if you want to contribute to the destruction of Tasmania’s iconic blackwood industry here’s the place to buy your timber. It’s a double whammy for the industry!

But if you want to support a profitable, sustainable forest industry then understand that time (and big trees) costs money!

Alternatively this price list may just reflect the fact that in Tasmania growing blackwood is according to Government policy a (taxpayer-funded if you are a public grower) community service not a business. These may just be community service prices, not real prices reflecting the cost of production let alone building and growing the industry.

In my next blog on blackwood pricing I’ll show an example of a better timber pricing structure together with much more realistic prices.

When will Tasmania get a fully commercial profitable forest industry?

Comments and ideas welcome!!

Hydrowood update

The long anticipated Hydrowood project is finally under way on Lake Pieman on Tasmania’s west coast salvaging specialty timbers from flooded hydro dams.

http://www.examiner.com.au/story/3505999/lake-pieman-site-of-australian-first-underwater-logging-video/?cs=95

http://www.abc.net.au/news/2015-11-20/the-hunt-for-sunken-treasure-harvesting-underwater-timber/6957388?WT.ac=statenews_tas

Here is the projects new website.

http://hydrowood.com.au/

I have both hopes and fears for this project in terms of what it could do for the special timbers/blackwood market.

My hopes are that through Hydrowood sales the company will provide much needed special timbers price and market transparency. This is unlikely to happen but I will certainly be encouraging the company management to adopt a commercial/transparent model.

The main driver that will encourage Tasmanian farmers to grow commercial blackwood is if there is much more price and market transparency. Can I get Hydrowood on board?

Ideally I would like to see Hydrowood set aside the very best logs from the salvage operation and every 3-6 months have a major auction.

Let us put 1,000 cubic metres of Tasmania’s finest timbers on the auctioneers table every 3 months and see what the market is prepared to pay!

Let us clearly demonstrate that the forest industry has commercial muscle and is no longer a community service.

Let us use this opportunity to stimulate interest in the real value of quality timber, and growing trees as a profitable investment and primary industry.

The fears are that a) they will flood the market and drive down prices, or b) the ST oligarchy that are currently pushing for World Heritage logging will force the Government to put restrictions on the Hydrowood markets/prices, or c) given the history of the last 40 years that this will turn into yet another Tasmanian forest industry disaster.

Hydrowood estimates they will salvage 80,000 cubic metres of special timbers over the next 3 years, with the possibility of the project lasting another 5 years. This is far more special timbers than has ever been supplied to market before. I would be surprised if the Australian market can absorb this volume of wood. Some of it will have to go to export markets. Perhaps all of it should go to export markets.

Much of this 80,000 cubic metres will be blackwood.

I don’t have a problem with our valuable timbers going for export, especially if they are attracting premium prices and the market is kept informed.

What this huge volume of premium wood will do for the special timbers market and for prices will soon enough become apparent.

The Hydrowood project will definitely have a prolonged and significant impact on the profitability of a number of important Tasmanian businesses. Consequently there will be political repercussions.

So now the Tasmanian special timbers market has four different classes of suppliers:

If the State Government goes ahead with logging the Tasmanian Wilderness World Heritage Area there will be a fifth supplier in the special timbers market – taxpayer-subsidised, unprofitable and unsustainable.

If that’s not a buyers dream market I don’t know what is!

How can Tasmania’s special timbers and blackwood industries have any future with this mess of a marketplace?

The only business model for a successful forest industry is profitable tree growing. So where are the profitable tree growers in any of this mess?

Does Tasmania really want a special timbers industry? It sure doesn’t look like it!

Dear reader, please think carefully before making your next special timbers purchase.

It really is a pathetic joke!

But good luck to the Hydrowood team.

It’s a shame we can’t have a profitable, commercial and sustainable special timbers industry in Tasmania, as well as the clean-up and salvage.

Some Hydrowood salvaged blackwood – unique but how valuable is it?

Leave a comment

Posted in Commentary, Forestry Tasmania, Markets, Politics

Tagged Hydrowood, special timbers