Above L-R: Tasmanian Blackwood 514ce-LTD, Walnut 414ce-LTD

For the fourth consecutive year Taylor Guitars included Tasmanian blackwood in a limited edition set. Spring 2010 saw 9 limited edition models of which 2 featured Tasmanian blackwood, this time in the 500 series thanks to the highly figured blackwood.

Bob Taylor and his design team herald spring’s arrival with a quartet of limiteds that promise to invigorate the senses.

Our Spring Limiteds have become one of those typically atypical Taylor design projects. Rather than making a firm commitment to come up with something each spring, Bob and his fellow designers wait to see if the product development stars align. Are there any reserves of exotic woods available that invite special treatment? Which models are generating lots of excitement around the factory? We think you’ll be happy with this year’s outcome (Wood & Steel Vol 63).

Tasmanian blackwood is often compared to its better-known cousin, Hawaiian koa. We gathered an assortment of impressively figured backs and sides for this run, making this a special upgrade to our 500 Series. Tonally, blackwood shares koa’s blend of midrange bloom and top end brightness, and will grow sweetly mellower over time, with great dynamic range.

Both models are topped with Sitka spruce and include Ivoroid binding, an abalone rosette, and an all-gloss finish [and gold-coloured tuners].

Tasmanian blackwood is often compared with Hawaiian koa as a tonewood. It’s a natural comparison to make but it can quickly turn to blackwood’s disadvantage if overdone as a marketing strategy. I think Tasmanian blackwood is more than capable of standing on its own two feet (roots??) as a quality tonewood.

Here’s a Spring Taylor 2010 516ce-LTD for sale on Reverb:

https://reverb.com/item/4445536-taylor-516ce-ltd-spring-limited-2010-tasmanian-blackwood-sitka

Production numbers (courtesy of Taylor Guitars) were:

| MODEL | PRODUCTION |

| 514ce-LTD | 301 |

| 516ce-LTD | 215 |

https://www.taylorguitars.com/

Over four consecutive years 2007-2010 Taylor Guitars produced almost 2,700 guitars across 9 Limited Edition models featuring Tasmanian blackwood.

My next spotlight will be on the 2012 Spring Limited Edition GS mini models.

Previous Taylor spotlights:

2004 Fall Limited Editions – when Taylor Guitars first introduced Tasmanian blackwood

Taylor GS4e 2007 Fall Limited Edition

The Radical Sawmill #2

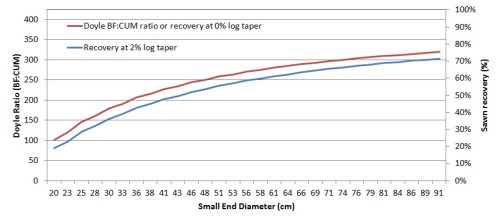

Some further thoughts on The Radical Sawmill and the Doyle Log Scaling Factor.

https://blackwoodgrowers.com.au/2017/09/04/the-radical-sawmill/

The American system of trading logs based on the Doyle Scaling factor means that every sale begins with the premise

“this log is a liability, the grower must be penalised”,

instead of

“this log is an opportunity, the grower must be encouraged to grow more quality logs”.

You would think under these negative conditions any serious forest grower would set up their own sawmill and do their own milling.

Why would a forest grower sell logs into such a punitive market?

Forest Grower and Sawmilling Cooperatives should be the order of the day in the USA.

For a forest industry looking to build its future the Doyle Log Scale is a very bad idea. It does nothing but send a negative message to the market.

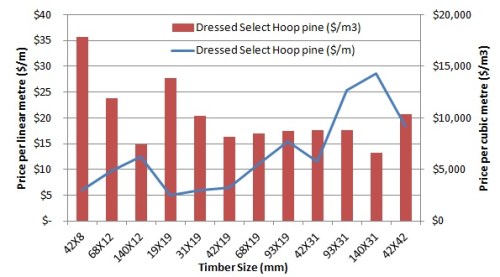

Not that the forest products market in Australia is any better. We have our own unique set of punitive measures to discourage private tree growers. But at least we do trade logs based on the small end or mid diameters. Or even a total log volume estimate based on SED and LED. The log is traded as an opportunity not a liability.

The Sunrise Sawmill in Ashville, North Carolina is obviously a small business, with limited resources for marketing and promotion.

How much is it really thinking about the future of the forest industry in North Carolina?

The State of North Carolina encourages private forest owners to develop a “Woodland Management Plan”.

http://ncforestservice.gov/Managing_your_forest/why_do_i_need_a_plan.htm

One of the objectives of these Plans is to improve the productivity and commercial value of the private forest through active management.

If I was a sawmiller thinking beyond my own needs to the future of the broader industry:

In fact the more I think about this the more I realise that whilst the sawlog may be important for the sawmiller for today, this week or this month; what is ultimately more important is the forest grower. How important is this forest grower to the sawmiller and the broader industry? That is the ultimate question for the sawmiller!

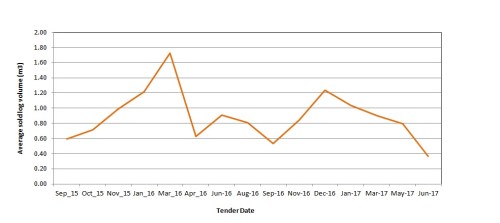

Greater log price transparency is a great beginning to help build the forest industry, but I suspect that much more is needed from the forest industry. The New Zealand experience supports this view. A broad level of industry/market support and encouragement is needed for landowners/forest owners to consider investing time and money over such a long period to grow quality wood.

As for North Carolina, North Carolina is home to 18.6 million acres (7.5 million ha) of forestland, 85% (6.4 million ha) of which is privately owned. Approximately 64% of these privately held lands are owned by non-industrial landowners. Despite the enormous growth our state has witnessed, 60% of North Carolina is still covered by forests.

https://www.ncforestry.org/nc-forest-data/forest-products-industry-in-north-carolina/

I wonder how many of these NC private forest owners have Woodland Management Plans?

Leave a comment

Posted in Commentary