It’s time for my annual summary of Island Specialty Timbers (IST) log tender results.

http://www.islandspecialtytimbers.com.au/

This is the only competitive market forest log price data publically available anywhere in Australia.

General

During the year Island Specialty Timbers conducted 7 tenders putting a total of 154 cubic metres of special species logs, craftwood and sawn wood to tender.

Total sold volume was 99.8 cubic metres (65%).

Total tender revenue was $90,900.

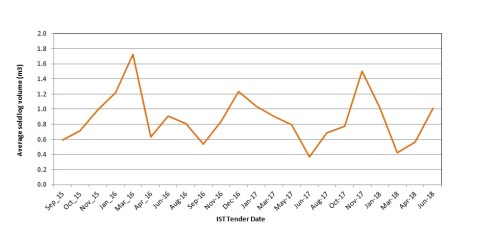

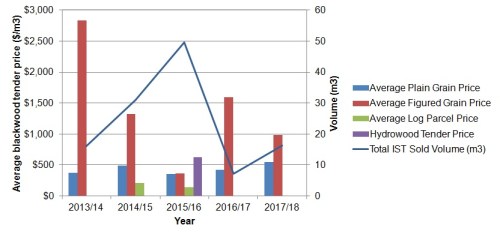

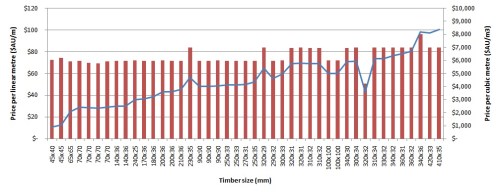

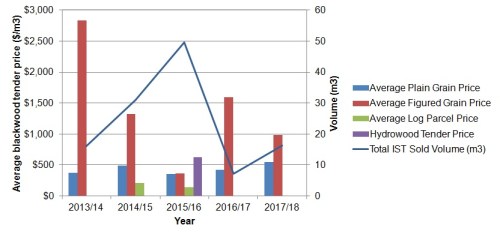

The above chart shows the log volumes and log prices paid per tender. Craftwood and sawn wood are not included in this chart.

The large volume of unsold logs at the April 2018 tender was mostly due to a large parcel of Silver wattle (Acacia dealbata) logs.

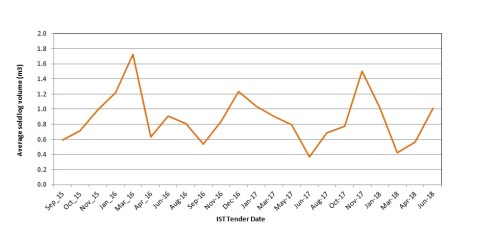

The above chart shows the average volume of logs sold at tender by IST. For some context to this chart, the target plantation blackwood log is 1.5 cubic metres in volume (DBH 60 cm pruned to 6 metres). So it can be seen most of the IST logs sold at tender are small to very small in size.

The highlights for the year were a) a tiny black heart sassafras log (1.1m length, 30 cm small end diameter, 0.07 cubic metres volume) that sold for $3,800 per cubic metre. Indeed at this August 2017 tender 5 small BH sassafras logs totalling 0.54 cubic metres sold for a total of $2,025; and b) a very large huon pine log (4.3 cubic metres) sold for a total $4,623.

Two species attracted strong demand and high prices during the year, these being black heart sassafras (BHS) and huon pine, with average log prices well over $1,000 per cubic metre. BHS and huon pine made up 21% and 13% respectively of the sold volume. Blackwood and feature eucalypt/tas oak were the other major sellers at 18% and 23% of sold volume.

In fact 2 tear-drop grain tas oak logs sold for over $1,700 per cubic metre, an extraordinary price for a wood that the market generally regards as a cheap commodity.

Celery top pine sold for an average $580 per cubic metre (3.7 cubic metres total sold).

Silver wattle and blackwood made up 76% and 15% respectively of the unsold volume for the year.

So what can we say with three years of IST tender results in the chart?

Answer: Not much!

There is no apparent trend in price over the last 3 years. Sure the volumes are small, the market is restricted and the quality of produce is highly variable.

What can be said is that even given these limitations the market will pay very good prices for quality wood when it wants to, with maximum prices averaging $3,000 per cubic metre, even for tiny logs!

These tendered log volumes represent less than 1% of the special timbers annual harvest, and a mere 0.01% of the wood harvested annually from public native forest in Tasmania. The rest is sold at Government (non-market) prices on long term, perpetual sales contracts.

According to Forestry Tasmania’s Annual Report in 2016/17 IST sold a total of 829 cubic metres of product [tender and direct sales]. The annual report does not give separate accounts for IST so their income and costs are unknown.

Blackwood

In general the IST tender results provide little information that is useful to the marketplace with the exception of blackwood. Tasmanian blackwood is the only Tasmanian “special species” that has the potential to be grown commercially; the other species being too slow growing.

Sixteen blackwood logs (23.5 cubic metres) were put to tender in 2017-18 of which 10 were sold (16.3 cubic metres) for a total of $12,210.

Five of the sold logs (7.6 cubic metres), described as having figured grain, sold for a total of $7,460. These logs averaged 5.2 metres length, 57 cm small end diameter and 1.5 cubic metres volume.

The 5 plain grain logs (8.7 cubic metres) sold for a total of $4,754, an average price of $545 per cubic metre. These five logs averaged 6.0 metres in length, 54 cm small end diameter and 1.7 cubic metres volume. In other words these were good size, quality logs equivalent to what can be grown in a well managed blackwood plantation, which would produce approx. 300 cubic metres of high quality sawlog per hectare at harvest.

This is a very good price and a substantial increase on the last three years.

The stand out blackwood results for the year were a) $1,300 per cubic metre for a 1.76 cubic metre log containing tear-drop figured grain, and b) $2,467 total price for a very large (2.53 cubic metre) figured log.

The unsold blackwood logs consisted of a) one huge figured grain log measuring 5.7m length 75 cm small end diametre and 3.4 cubic metre volume, and b) 5 plain grain logs averaging 4.3 metres length, 46 cm small end diameter and 0.8 cubic metres volume.

Remember these are tiny volumes in a small market (southern Tasmania). Whether they represent the broader blackwood market is unknown.

Remember these prices are “mill door” equivalent prices with harvesting and transport costs already “included”. They are not stumpage prices.

Also remember that Sustainable Timbers Tasmania/IST is a taxpayer funded community service organisation bringing these timbers to market from Tasmania’s public native oldgrowth and rainforests:

Tasmanian regional forest agreement delivers $1.3bn losses in ‘giant fraud’ on taxpayers

Tasmanian blackwood makes it to the top of the Taylor tree

The latest Taylor Guitars Wood & Steel magazine (Vol. 93 2019 Winter, p. 28) shows us that Tasmanian blackwood has finally made it to the peak of Taylors model range.

https://www.taylorguitars.com/wood-and-steel

Fifteen years after introducing Tasmanian blackwood into their limited production and three years after introducing blackwood into their regular production in the 300 series models, Tasmanian blackwood is now included in Taylor’s top-of-the-line Presentation Series (PS) models.

The Presentation Series are an annual limited edition series of guitars that feature premium woods and premium appointments.

Our Presentation Series celebrates the finest in materials and craftsmanship detail. This year we’re thrilled to introduce the wood pairing of figured Tasmanian blackwood and Adirondack spruce to the collection. Tonally, we love blackwood — it’s loud, responsive and warm, yet with a clear focus. The sets we’ve selected boast a beautiful blend of variegation, figure and grain structure reminiscent of Hawaiian koa, featuring golden-brown and dark amber ribbons of color. Together with a top of creamy Adirondack spruce, this guitar is no mere showpiece; its dynamic voice is ripe for the picking (or strumming). Or, if you prefer the rich, dark variegation of a sinker redwood top, the option is yours. We’ve also shifted from a beveled armrest to our radius contouring, which ensures comfort for players of all sizes. Our elegant suite of aesthetic appointments saves the understatement for other models, tracing the lines of the guitar with sparkling paua and other eye-catching ornamentation, including our intricate Nouveau fretboard/ peghead inlay. From every angle, these guitars deliver stunning aesthetic appeal.

Tasmanian blackwood Presentation Series models to become available are: PS12ce, PS12ce 12-Fret, PS14ce, PS16ce, PS56ce, PS18e.

These guitars are so new they haven’t yet made it onto the Taylor website. Stay tuned!

https://www.taylorguitars.com/guitars/acoustic/features/series/presentation

Prices for Presentation Series guitars start around $US9,000. These are top-shelf guitars for people with deep pockets.

Even despite the inevitable “koa’s poor cousin” comparison, Taylor are obviously confident they are making progress getting Tasmanian blackwood accepted into world guitar markets.

Congratulations Taylor Guitars!!

For Tasmanian farmers to get their product into the top of the market should be an occasion for recognition and celebration.

Unfortunately that is not how wood markets operate.

Is this extraordinary market achievement resulting in more Tasmanian blackwood being planted by Tasmanian farmers?

Surely it should!

Utilising market forces (price, supply, demand, achievements, etc.) to help drive the future of the blackwood industry should be the backbone of industry and Government policy.

Unfortunately market demand just helps the Tasmanian Government/Parliament justify logging native blackwood forest in our Conservation Reserves.

Thankfully this is not where Taylor Guitars source their blackwood timber, which comes from Tasmanian Tonewoods salvaged from Tasmanian farms.

https://tasmaniantonewoods.com/

But in the opaque world of the global timber trade politics and greed often confound good intensions.

So here’s the take home message:

Tasmanian blackwood timber achieves another major international market milestone (thanks Taylor Guitars!!!), but no Tasmanian farmer will learn anything about this achievement, let alone be moved to invest in planting blackwood for the future.

Are you beginning to understand the problem we face?

Leave a comment

Posted in Commentary, Markets, Taylor Guitars, Tonewood